My Account

Follow us on:

Powered By

Find & Invest in bonds issued by top corporates, PSU Banks, NBFCs, and much more. Invest as low as 10,000 and earn better returns than FD

Invest Now

Powered By

Unlock Your Trading Potential: Trade like Experts with SEBI registered creators, Learn from Courses & Webinars by India’s Finest Finance Experts.

Invest Now![]()

AMBAREESH BALIGA

Fundamental, Stock Ideas, Multibaggers & Insights

Subscribe

CK NARAYAN

Stock & Index F&O Trading Calls & Market Analysis

Subscribe

SUDARSHAN SUKHANI

Technical Call, Trading Calls & Insights

Subscribe

T GNANASEKAR

Commodity Trading Calls & Market Analysis

Subscribe

MECKLAI FINANCIALS

Currency Derivatives Trading Calls & Insights

Subscribe

SHUBHAM AGARWAL

Options Trading Advice and Market Analysis

Subscribe

MARKET SMITH INDIA

Model portfolios, Investment Ideas, Guru Screens and Much More

Subscribe

TraderSmith

Proprietary system driven Rule Based Trading calls

Subscribe![]()

![]()

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Subscribe

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Explore

STOCK REPORTS BY THOMSON REUTERS

Details stock report and investment recommendation

Subscribe

POWER YOUR TRADE

Technical and Commodity Calls

Subscribe

INVESTMENT WATCH

Set price, volume and news alerts

Subscribe

Using data gathered from various sources, from tax filings and bank accounts to credit card issuances and mobile phone subscriptions, analysts at Goldman Sachs have found the rapid increase of a demographic in India.

In the recent report titled “The rise of the Affluent India”, the analysts have said that people who earn $10,000 annually have grown at a rapid clip. The number of these affluent Indians have grown at 12 percent CAGR over 2019-23 versus the 1 percent CAGR of India’s population.

Also read: ‘Affluent India’ growing at 12% vs total population’s 1%, divergence seen in stock performance: Goldman Sachs

Here are the five charts that illustrate this trend.

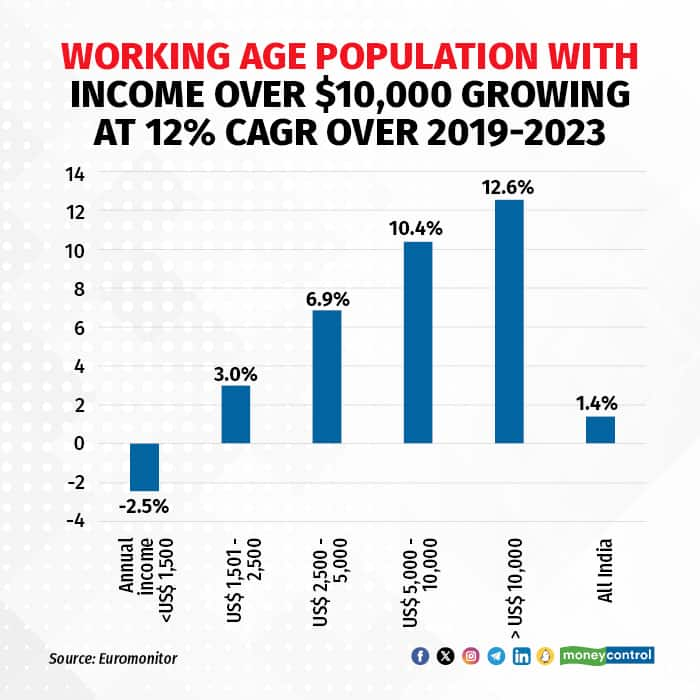

1. The total number of people with an income over $10,000 in the working age population of India has grown at a CAGR of 12.6 percent over FY19 23,as per Euromonitor. This compares with the overall working age population CAGR in India of 1.4 percent over FY19-23.

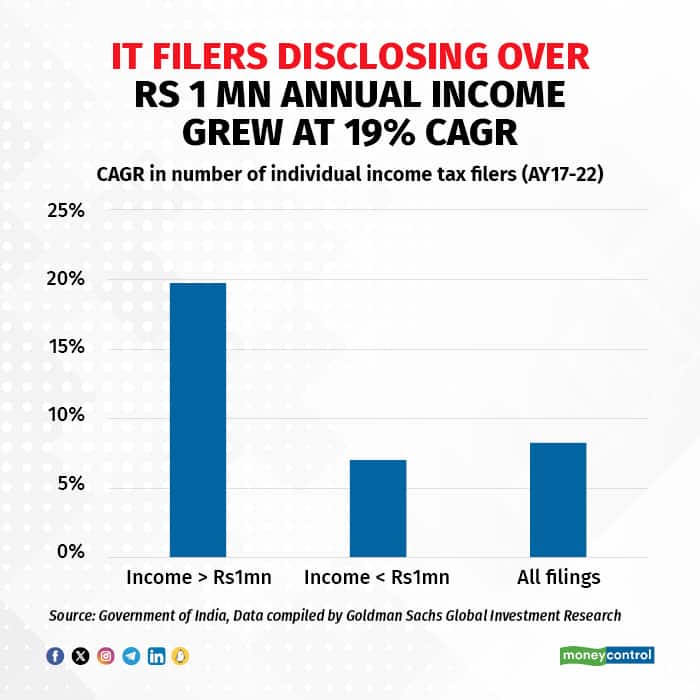

2. The total number of individuals filing income tax returns disclosing income of over Rs 1 million (~$12,000) has grown at a CAGR of~19 percent over AY17-22, compared to the overall growth of income tax filings which has grown at a CAGR of 8 percent in the same period.

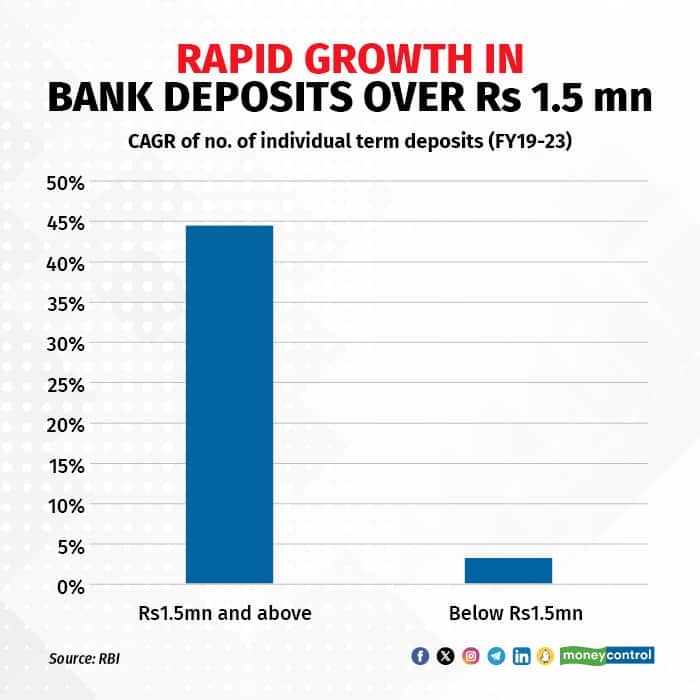

3. The number of individual term deposits in banks above Rs 1.5 million (~$18,500) has grown at a CAGR of 45 percent over FY19-23, while the number of term deposits below the Rs 1.5 million has grown at a CAGR of 3 percent over the same period.

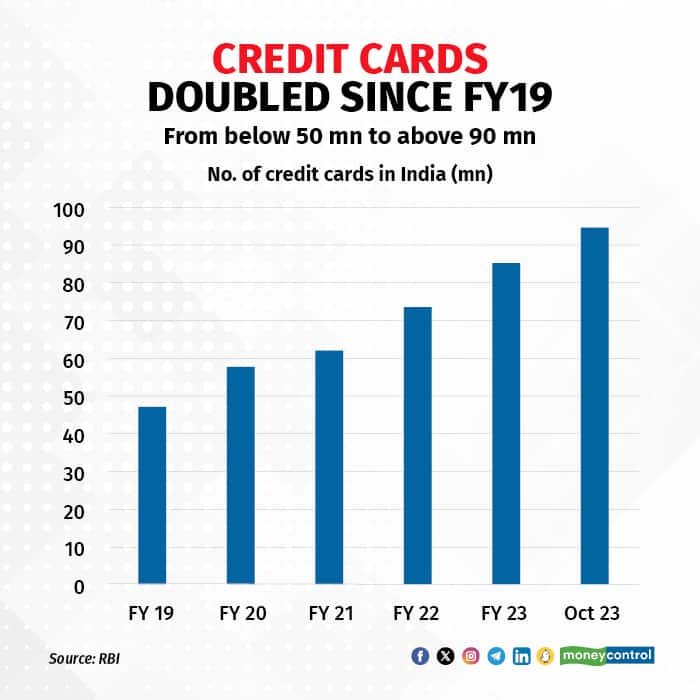

4. The number of credit cards in India has grown at a CAGR of 16 percent over FY19-23, compared to the number of debit cards which grew at a CAGR of around 1 percent in the same period. There were ~85 million credit cards in India in FY23, compared to ~960 million debit cards.

Also read: 8 stocks that stand to profit from ‘Affluent India’, according to Goldman Sachs

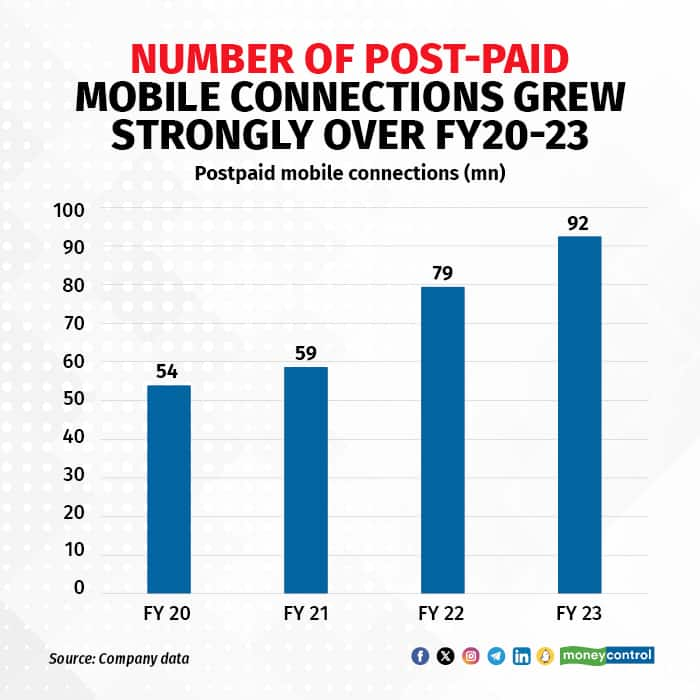

5. The number of post-paid connections rose by nearly 30 percent over FY21-22.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Copyright © e-Eighteen.com Ltd. All rights reserved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited.

You are already a Moneycontrol Pro user.

Access your Detailed Credit Report – absolutely free